The private residential market in Singapore has shown resilience with a notable increase in property prices and sales volume during the third quarter of 2025. According to the Urban Redevelopment Authority (URA), the property price index rose by 1.2% in Q3, up from 1% in Q2 and 0.8% in Q1. Year-to-date, prices have grown by 3.1%, surpassing the 1.6% growth in the same period in 2024.

Non-landed homes experienced a faster price growth, with a rise from 0.7% in Q2 to 1.1% in Q3. In the prime Core Central Region (CCR), prices increased by 2.4% quarter-on-quarter, although this was slower than the 3% rise in the previous quarter. The suburban Outside of Central Region (OCR) saw a 1% increase, slightly down from 1.1% in Q2, whilst the Rest of Central Region (RCR) reversed a 1.1% drop in Q2 with a 0.4% rise in Q3.

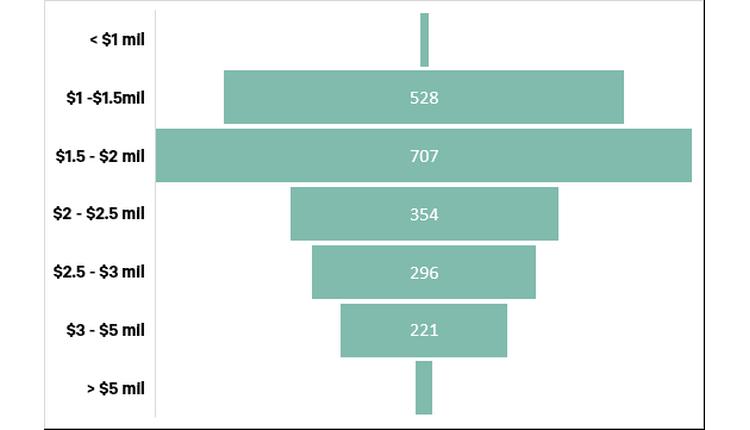

Christine Sun, Chief Researcher & Strategist at Realion, noted that the price growth in the CCR was driven by a significant increase in new sale transactions, which jumped from 44 units in Q2 to 896 units in Q3. Similarly, new sales in the OCR rose from 263 units to 1,279 units, and the RCR registered 1,067 units, up from 883 units in Q2. The overall price increase was also influenced by a 24.1% rise in higher-priced transactions, with 1,340 units sold for more than $2.2m (S$3m) in Q3, compared to 1,080 units in Q2.

Looking ahead, demand for new homes is expected to remain strong in the final quarter of the year, with several new developments set to launch. Developers are likely to expedite project launches to capitalise on the positive sales momentum. Additionally, with the Federal Reserve’s recent interest rate cut and potential further reductions, property investment is expected to become more attractive. Prices for the overall market are anticipated to rise by 3.5% to 5% for the whole of 2025.